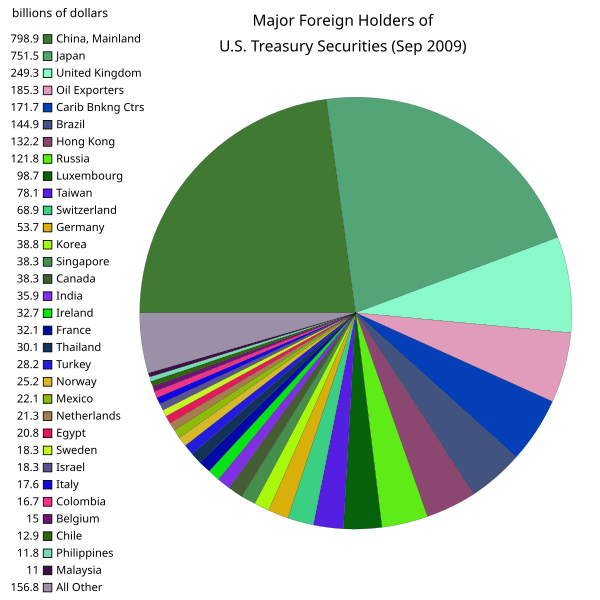

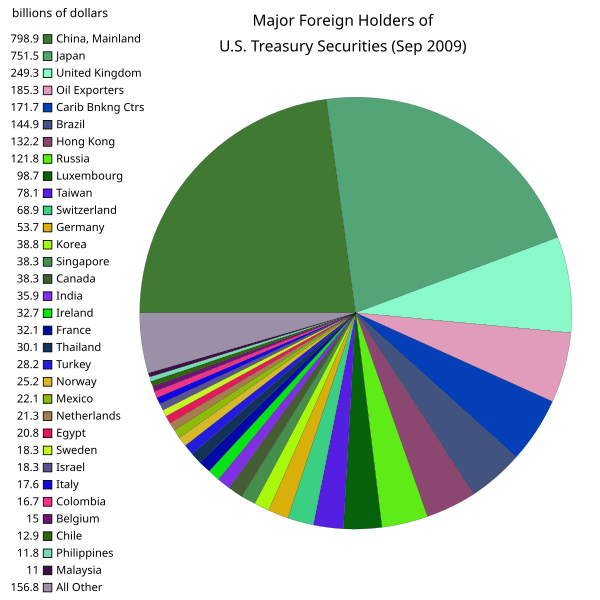

The US bailed sponsors with loaned money... Say thanks to China and Japan (Colombia throwed in 16 billion... so, you're welcome).

Hong Kong has a whopping 132, too~~~Ciro Pabón wrote:The US bailed sponsors with loaned money... Say thanks to China and Japan (Colombia throwed in 16 billion... so, you're welcome).

Yes, thank you for your charitable investment in T-bills.Ciro Pabón wrote:The US bailed sponsors with loaned money... Say thanks to China and Japan (Colombia throwed in 16 billion... so, you're welcome).

Ahh, but that's the problem. The government hoped/thought that they could force reforms on the banks that took the money, but the banks just pointed to what would happen if they didn't get the cash, and said thanks but no thanks on the reforms. Its practically a protection racket.richard_leeds wrote:Ciro - Thanks for bringing some perspective to all this. I was surprised the thread wasn't locked when I read the bits about suicide, murder & jewish usury.

Tau - as for loans to companies linked to non-USA parents - the point of the bailout was to underwrite the toxic debt. Those loans were taken out by USA citizens and companies, it was USA debt bailed by USA bond issues. If for instance the USA holdings of Barclays Capital were not supported, then USA people employed by the USA subsidiary of Barclays would have lost jobs, USA companies with Barclays bank loans would have closed down, USA homeowners with USA mortgages based on USA Barclays mortgages would have been homeless.

Furthermore, the USA credit ratings would tumble, future foreign capital in the USA would be very hard to come by and that would have killed any hope of economic recovery.

Yes it would have been nice to see more headline grabbing reforms. However, banks now have to show greater capitalisations and pass tougher "stress tests". We are likely to see separation of the capital (gambling) from the retail.Pup wrote:Ahh, but that's the problem. The government hoped/thought that they could force reforms on the banks that took the money, but the banks just pointed to what would happen if they didn't get the cash, and said thanks but no thanks on the reforms. Its practically a protection racket.