Oh but running a F1 team never will make sense in my eyes. I'm not going to argument that; I just believe OVO is capital-wise able to do so.SidSidney wrote:Sure, that is (usually) true, but what is also true is thtat those debts are locked to assets i.e., cash balances, on which the bank has the first call. I was running a much more profitable $100m turnover software business in Britain between 2007-10 and I have direct personal experience of how that process works... Anyway, my point is: how does that picture square with taking on a cash sinkhole like an F1 team?turbof1 wrote:That kind of debt vs. the total activa/passiva is hardly an issue. Having debt is a standard tool for companies, especially due financial leverage, and is often and widely employed.

Sure, you can see the signs of improvement as they amortise overheads through expanded sales volume. Again though: how does that picture square with taking on an F1 team? If big multinationals look twice at funding McLaren, how does a plucky barely-profitable low margin early stager think they can do it?turbof1 wrote:Losses are to be expected. The company has only started in 2009; you can't expect that a new supplier on highly dominated and saturated market like the British Energy Market (90% of it is in hands of the Big Six, OVO is not one of them) to make profits the first few years. The long term is more important here, and it looks like OVO is hitting the targets: steadily decreasing losses the first few years, then make profit.

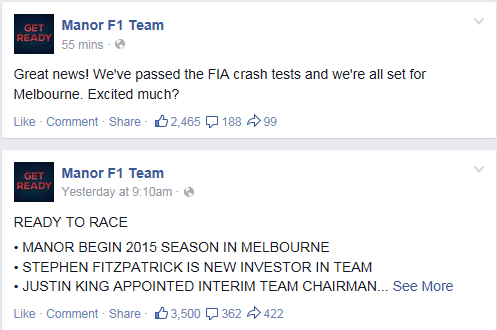

My answer: on the cheap and by being optimistic. But those days are long gone. It will be sunshine and glory for a few months then back to the same old moans about cost and no sponsors.

It's not an usual construction from which OVO is funding the team though. Looks like Fitzpatrick set up a structure where he personally is responsible, but gets the effective funds out of ovo. Looks like that he wants to keep ovo out of it when it does go wrong.