- Login or Register

No account yet? Sign up

I'm not saying there aren't others like F1 drivers - elite tennis players, golfers, any well-paid 'touring' sport really, - but elite F1 drivers are amongst a very, very, very small portion of sportspeople (and even even smaller % of the general population) who are always on the move and are likely to end their career with a multi-million fortune amassed. F1 drivers also appear to the outside to be employed by a team rather than earning prize money as you do in most other touring sports.turbof1 wrote: ↑07 Nov 2017, 16:08Again, that's not an abnormal thing. For instance, a CEO is by the nature of his title an employee. However, if he has enough capital himself he'll put in it in some sort of holding.Ennis wrote: ↑07 Nov 2017, 15:25The strange breed comment was in relation to their type of life, and our perception of that life rather than their tax arrangements in isolation.

We perceive them to be employees when they are much more like corporations. Even most other highly paid sportspeople tend to reside somewhere fairly permanently, it's difficult to tie an F1 driver to a 'home'.

There are more sportsmen and women constantly on the move than you think. Consider Andy Murray or Andre Greipel. They perform their sport across the globe, meaning they will be months away from home. That does make tax affairs a very complicated thing, however.

There are a million things you should be more angry about. Don't hate the player, hate the game. E.g. the problem isn't that people/companies/corporations do what the law legally allows them to (= optimise their tax), the problem is with the government that allows this to happen. They are doing what you should be doing too: optimise your tax in the (little) ways you can.Vasconia wrote: ↑07 Nov 2017, 17:19I am angry both with those big companies and those personalities. There are millions and millions of dollars/euros in taxes which should be destinated to improve our structures, economy, social healthcare,etc. They must pay.

Its easy to say how proud of being...(insert nationality) they are but they hide their money in those places. Hypocrites.

Your anger is misdirected. You shouldn't be getting angry at the companies or the people - they're following all the rules.Vasconia wrote: ↑07 Nov 2017, 17:19I am angry both with those big companies and those personalities. There are millions and millions of dollars/euros in taxes which should be destinated to improve our structures, economy, social healthcare,etc. They must pay.

Its easy to say how proud of being...(insert nationality) they are but they hide their money in those places. Hypocrites.

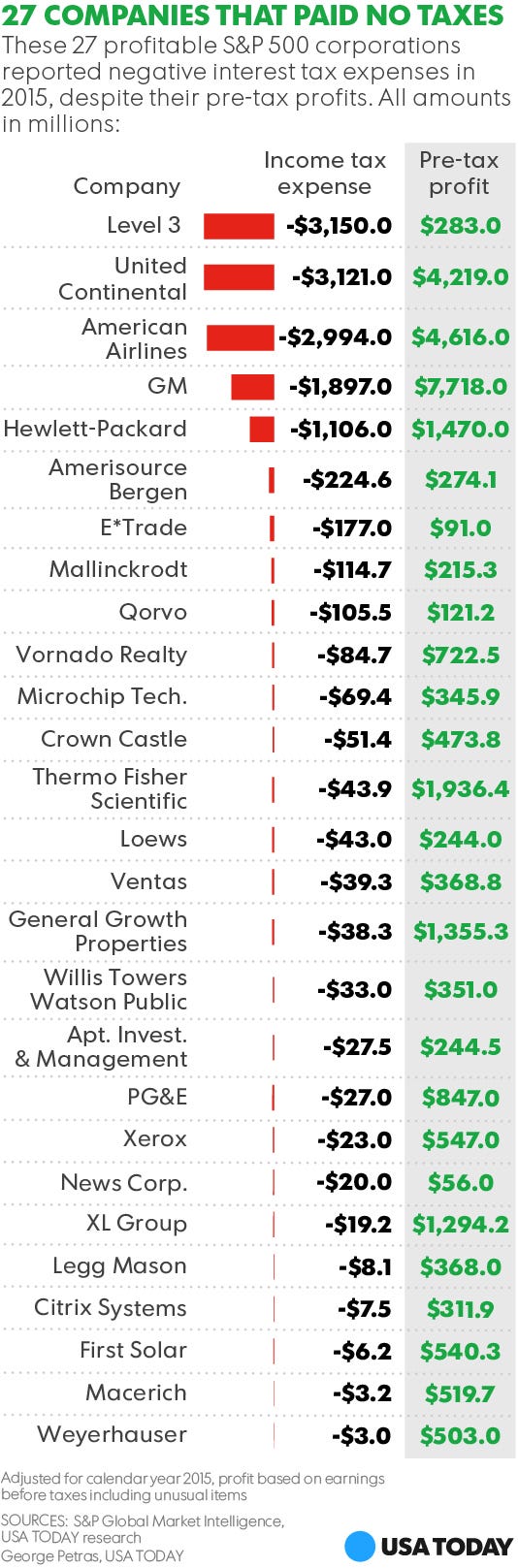

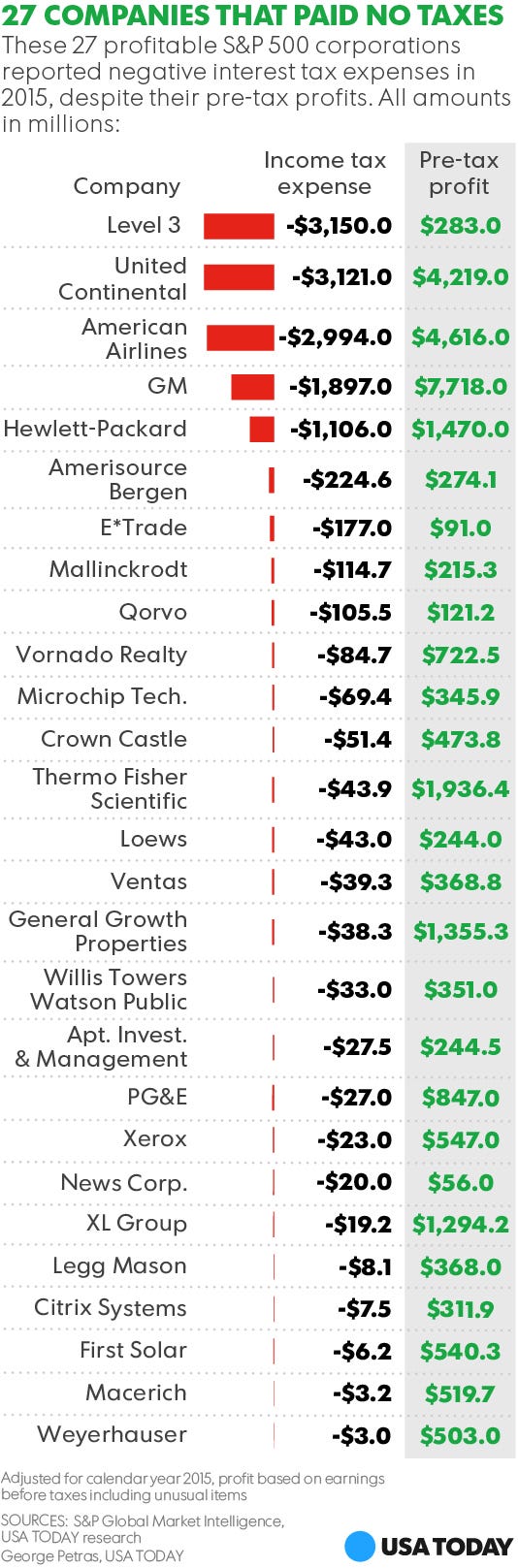

In the US, (probably not unlike other countries) simply more pronounced and visible here, the companies pay the politicians to enact their policies. So there's plenty of blame to go around. There's a lot of oligarchy in the world, but usually it's behind a curtain that's behind a curtain in case someone inadvertently peeks behind the first.Moose wrote: ↑07 Nov 2017, 17:45Your anger is misdirected. You shouldn't be getting angry at the companies or the people - they're following all the rules.Vasconia wrote: ↑07 Nov 2017, 17:19I am angry both with those big companies and those personalities. There are millions and millions of dollars/euros in taxes which should be destinated to improve our structures, economy, social healthcare,etc. They must pay.

Its easy to say how proud of being...(insert nationality) they are but they hide their money in those places. Hypocrites.

Instead, you should be getting angry at your MP, and demanding that the rules are changed so that these people and companies actually do have to pay a reasonable amount.

Meanwhile in Malta the journalist is exploded in her car.

Ennis wrote: ↑07 Nov 2017, 12:11F1 Drivers are a strange breed. They don't sit in their house in one country and head out to work every day. They live in the air, own multiple homes in multiple locations, and the only time they really settle anywhere is when they're not working (during which time I believe Hamilton tends to go to his house in Switzerland). Where should he pay tax? UK, Monaco (ha), Switzerland, the US, or a small margin to every country where he earns money?

Hamilton is basically a corporate entity, and his tax arrangements are set up as such. His statement is an old one prior to this most recent release where I believe it was more just general complaints about his tax-paying in the UK (because he resided in Switzerland/Monaco) rather than something more specific.

Speaking generally about the press manhunts -

I could be wrong of course but Hamilton particularly doesn't strike me as the kinda guy who wants to be distracted by managing his own portfolio. They hire a guy, that guy provides a return on investment. Ignorance is never the best defence, but really do we believe a bunch of sportspeople and people involved in showbiz are all finance gurus?

I don't agree with this going after Hamilton, nor did I agree with them going after Gary Barlow or Jimmy Carr.

When they get access to data like this, I fully agree with exposing those people who have the capability to influence the rules and take advantage of this. Politicians, media owners, people who donate to political parties, the Queen (!!!) - that type of person. They could be using their influence to not only identify but actually create loopholes for themselves.

For those simply following the rules, often at an arm's length through a financial advisor anyway? Complete distraction from those who should be the real targets.

My wife and I do it every time we go to toss out something that wasn't trivial to buy new. We donate it, and get a charitable donation deduction.

What you don’t do is set up a charity, donate your high value items to it, and then have the charity lend you the item back.

How is it a slap in the face? The people named on the paradise papers would pay a 'peasants' tax in a heartbeat.oT v1 wrote: ↑07 Nov 2017, 20:20It’s a sad state of affairs when the head of state (uk) is doing the same. That’s the biggest shame of the document for me, none of it illegal but it’s a bit of a slap in the face to the peasants like me. I wouldn’t mind the celebs like HAM.....but not the queen for Christ’s sake.

The mainstream should be educated on this though, because it shouldn’t be headline news every time, as long as there’s a legal way to do it, everyone should try and maximise their own capital.

The rich don't keep nearly as much money as people think they do. They might lower their personal income tax, but they still end up shelling out a lot of money.Moose wrote: ↑07 Nov 2017, 22:54In most of the western world, the very rich pay a lower percentage rate of tax than the middle class, due to being able to do things exactly like Hamilton has done. Create companies, have those companies buy things, and then use the company's resources instead of your own. That way you have very little income, and hence pay very little tax, but the resources to have the life of a rich man.

not to long ago I read a paper that theorized one of the underlying reasons for this was that technology allowed intelligent and/or highly motivated people to more efficiently make money. It also did away with the jobs held by those of lower intelligence or motivation.Moose wrote: ↑07 Nov 2017, 22:54The result of that is that the equity gap is growing, and has been growing for several decades now. The reason that people are angry about this kind of thing is exactly because there's massive inequity at the moment, and they want something done to force a correction.

I think this is highly unlikely, as most of those who are leaning this way are young, and haven't really shown themselves to have the stomach for that kind of violence. Not to mention The percentage of the middle and upper class that are armed is high enough to shock most Europeans.